I know what you’re thinking…it’s still only September so why are you talking about tax season?

It’s still miles away…right?

Wrong. We’ve basically got three months until the end of year. It’ll be here before you know it.

Now, if you’ve spent the better part of the year keeping track of your finances then you’re already ahead of the game. You probably don’t have to read any further…you know the drill. However, if you haven’t, there’s still time for you to get there – but you should start now. So continue reading.

Keeping track of the finances of your online business can be tedious but if you start now…when tax time finally comes, you’ll be glad you did.

So let’s get started…

There are two main aspects of taxes; income and expenses. Whether you file as a freelancer, sole proprietor or under an actual business name with a tax ID you’ll need to report both. I prefer to keep track of everything throughout the year instead of scrambling last minute to find all my receipts. Doing it this way keeps me organized and gives me peace of mind.

Here’s what I do:

1. Log all expenses on a weekly basis

2. Log all income on a monthly basis

For me, expenses take up a lot more space than my income. So keeping track of expenses weekly ensures I am not missing anything. Since my income is less frequent, I can easily log that in on a monthly basis. It’s also easier to track that way.

What counts as ‘expenses’? Anything you purchase to help run your business. This can include (but not limited to);

hardware (computer, printer, etc.)

software (apps, paid email software, etc)

subscriptions (online storage space, etc)

education (courses, classes, etc)

advertising & promotion (paid ads, etc)

design assets & artist tools (ie; brushes, paints, etc)

What counts as ‘income’? Any money you make whether from your online business, your job or otherwise.

For example; if you are running a small online business and working (whether part/full time) or do some freelance on the side…you obviously need to report all of it. Though there may be cases where you don’t such as when you’ve made less than $600 for the year. If you do make $600 or more on say Etsy (or a similar marketplace) they will generally send you a 1099 at the end of the year. So if you are keeping track of your income in real time, you’ll already have an idea as to where you’ll be at by the time these 1099s show up in your inbox.

Also due to the new American Rescue Plan Act of 2021; marketplaces such as Ebay, Postmark, etc are now required to send 1099s to any seller who made $600 or more in the year (it used to be $20k). So even if you decided to sell some old items from your closet to earn a little extra cash, and you made $600 (or more), you’ll now have to report it to the IRS as income. There may be a workaround coming for those occasionally selling old items at a loss, but for now it’s better to include that in your income when filing taxes. Personally, I just report everything and talk to my tax person when time comes.

The best way to keep track of income & expenses is to not only use my method above but also to keep receipts. The rule of thumb for the IRS is to keep all your receipts for three years. You may not ever need to show these receipts but in the event you do, you’ll have them on hand.

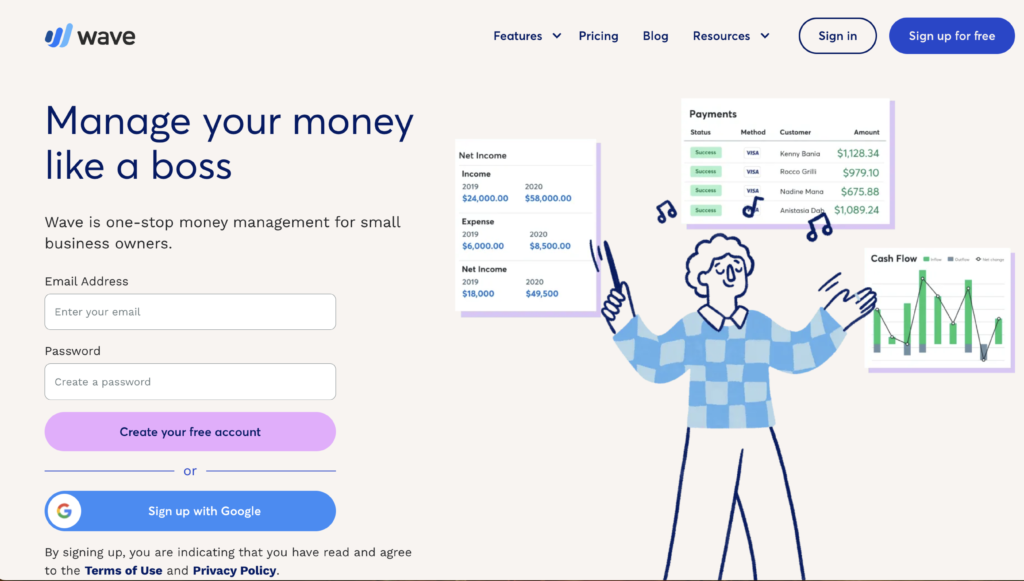

So what’s the easiest way to keep track of everything? If you have QuickBooks, that’s great. Many small businesses use it but it does cost money. I’m not big enough just yet to fully utilize that program. If and when I do, I might consider buying it but for now I can easily keep a running tally on my own situation using this fantastic *free* online app that I have mentioned before called Wave App.

What I love about this app is that it’s so easy to use. Simply log in each expense separately and upload the corresponding receipt to keep it stored directly with the expense. It works the same for income. They have a paid version but if you’re just starting out, you likely won’t need that.

Even with the free version you’ll get access to reports which you can send to your accountant for easy filing. I would get this app now and start logging in everything. The best way to be organized come tax time is to be organized all throughout the year.

TL;DR – the more prepared you are with your business finances now, the easier it will be to navigate the coming tax season. Not to mention, your accountant will thank you for it.

Until next time…

Great advice in a friendly personalized manner. Thank you, Mary

Thank you!